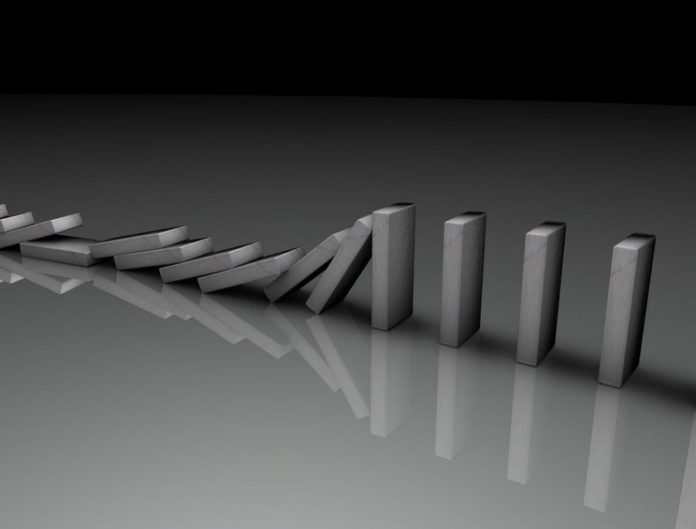

The world’s largest cryptocurrency, Bitcoin [BTC], appeared to be moving sideways after its fall on May 30. The coin’s fall had also caused other major coins to collapse. BTC surpassed its $8k resistance recently, while also briefly grazing the $9k resistance before falling to the $8,500 range. However, the coin was yet to recover from this position.

BTC fell by over 4% within 2 hours and proceeded to form a new red candle. After the May 30 fall, BTC fell by over 8% and was valued at $8,504.75. However, according to data collated by CoinMarketCap, the coin was highly traded at $8,526.83 with a market cap of $151.24 billion. The 24-hour trading volume was noted to be $20.67 billion as it fell by 1.77% in an hour. Over the past seven days, BTC slipped by 2.34%.

The coin was highly traded on BitMEX via the XBT/USD pair. The pair noted a trading volume of $3.01 billion. BitMEX was followed by Negocie Coin which registered a trading volume of $1.83 billion via the BTC/BRL pair. The third place was taken by Coinall, with a volume of $727 million via the BTC/USDT pair.

This downtrend was followed by a report that BTC fell by a massive 98%, a low that had not been visited since 2013. The one-day chart of the coin noted this June 2 fall, with its wick reaching as low as $101.2 Canadian Dollars [CAD] on the San Francisco-based exchange.

This raised concerns among the crypto community, with @Mercerado, commenting,

“Flash crash on @krakenfx illiquid #bitcoin fiat markets 1500 $BTC dump to scoop 1150 BTC at 101 $CAD ??♂️”